Introduction

Spotlight on Quality Programme

1.1 Following the end of the UK’s membership of the European Statistical System, the Office for Statistics Regulation (OSR) has been developing its approach to providing continued assurance that the UK statistical system produces high-quality, internationally comparable economic statistics. OSR’s primary focus has been a programme of assessments of economic statistics, with a particular emphasis on quality. There are several strands to this work:

- the quality-focused assessments programme, which has so far seen us publish assessments focusing on the quality strand of the Code of Practice for Statistics, including for Producer Price Indices and for Profitability & Gross Operating Surplus

- the Spotlight on Quality Framework underpinning those assessments

- a systemic review of economic statistics

- ensuring confidence in economic statistics classifications, a workstream which aims to provide assurance around the process for classifying units, assets or transactions and constitutes the focus of this review.

Ensuring confidence in public sector classifications

1.2 Our review into classifications was conducted in recognition of the changing context around the classifications process since the UK exited the European Union. This period also coincided with the coronavirus (COVID-19) pandemic and the economic and energy price shock that followed Russia’s invasion of Ukraine.

1.3 OSR spoke to colleagues involved in making classification decisions and a range of users. We would like to thank them all for giving up their time to provide their thoughts and insights during the review.

1.4 The integrated nature of the UK’s classifications decisions, which have statistical, financial and practical impacts, means that the direct users of classifications fall into three categories:

- official statistics producers affected by classifications decisions. These are typically the producers of the UK National Accounts and the producers of statistics on public sector finances and public sector employment. The producers of the UK National Accounts need to understand which part of the accounts is affected by each decision, and how and when such a measure should be implemented in the national accounts in practice. Sometimes the cases considered can also have implications for a broader range of economic statistics, including prices.

- departments affected by classifications decisions because of an explicit public finance remit, including HM Treasury and the Office for Budget Responsibility (OBR). Classifications decisions such as the reclassification of Network Rail from private to public sector, for example, impact debt and deficit statistics. Given that the government fiscal rules are linked to these data, classification decisions in turn will have implications for medium-term decision-making on tax and spend (for example, decisions made during the UK Budget), as well as the day-to-day management of public money.

- other government departments or agencies, which are affected by a request for the classification of a specific unit or policy initiative in their work area. This could be, for example, an agency that is controlled to some degree by a government department being reclassified. These bodies are affected by classification decisions because of their practical implications. For example, bodies that ONS classifies as part of central government are subject to a range of controls, like pay controls and Managing Public Money requirements.

1.5 This report summarises the findings of our review and presents six requirements that ONS must meet to maintain and, in places, enhance the quality and communication of classifications decision-making.

The economic statistics classification process

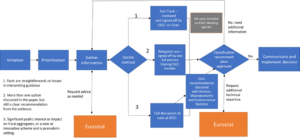

Figure 1: Process map for classification decision-making, including processes involving Eurostat from when the UK was a European Union member

Economic statistics classifications are decided by ONS. Figure 1 shows the decision-making process, including when the UK was part of the European Statistical System and so under EU regulations. The first box shows “Initiation”, then a rightward arrow to “Prioritisation” and then a rightwards arrow to “Gather information”. From “Gather information”, there is a downwards arrow to Eurostat to “request advice as needed”. There is also a rightwards arrow to “Decide method”. From “decide method” there are three arrows: Arrow 1 (labelled as such) denotes “Fast Track”; Arrow 2 denotes “Delegated Case”; and Arrow 3 denotes “Full discussion”. These are the different “methods” for making recommendations on classification cases, and there is then a box that states “All cases included on the Economic Statistics Classification Committee (ESCC) meeting agenda.” From the “Full discussion” box, there is a diagonal arrow saying “recommendations discussed with Director” and then another diagonal arrow to “Classification recommendation approved”. From that box, there are three arrows: one that goes all the way back to “Gather information” in the event of “No approval, need more information”. There is also a downward arrow to “Eurostat”, when there is a need to “request additional technical expertise (rather than approval)”. Finally, there is a rightwards arrow to “Communicate and implement decision” if the recommendation has been approved (i.e. a decision had been made). Following the UK’s departure from the EU, only the process flows to Eurostat no longer happen.

1.6 The ONS Economic Statistics Classification Committee (ESCC), a panel of ONS staff members who are experts in national accounting, is responsible for establishing the correct statistical treatment of all the units and key transactions covered by the UK National Accounts. The balance of classification cases can shift depending on policy context; for example, during the COVID-19 pandemic, there was an increased emphasis on classifying the transactions resulting from the rapid introduction of government policies to support businesses and households.

1.7 Requests for classifying are made to the ONS Economic Statistics Classifications Team. The Classifications Team currently comprises eight members of staff, an increase from six in 2020. While occasionally an individual department or agency will contact the Classifications Team directly about a request, in practice a request for classification is typically made by HM Treasury, the Scottish Government, the Welsh Government, the Northern Ireland Executive and other teams within ONS on behalf of other departments or bodies within its public finance remit. They will be involved in the request from the beginning and then act as an intermediary between the department or agency making the request and the ONS Economic Statistics Classifications Team.

1.8 The Classifications Team gathers relevant information to fully understand the request. This is a thorough process and sees the team engage with relevant parties (the department or agency affected, or the department who initiated the request) to compile the full range of necessary background information. It also comments on the application of international standards that are relevant to the decision. Before exiting the European Union (EU), the team would also seek relevant guidance from Eurostat, the EU’s statistics agency, whose responsibilities included ensuring that the UK was complying with EU law on deficit and debt. Once this process is complete, the case is taken forwards by the Classifications Team to decide which approval route (see paragraph 1.13) should be used.

1.9 The Classification Committee comprises experts with different specialisms and skills from across the spectrum of ONS’s economic statistics. This range of backgrounds helps ensure that there is an appropriately rounded mix of expertise to fully examine any case being assessed. The committee can also ask specific experts from outside of this group to provide advice on relevant cases should the need arise; this option is rarely used. Currently, there are 19 committee members, including 2 co-chairs. Nine members have served on the committee for more than five years. There is no expected or maximum time that the committee members serve for.

1.10 New members are recruited to the Classification Committee as needed, based on their role and expertise and in accordance with the Committee’s Terms of Reference. Only the names of the two committee co-chairs are publicly available, while the other members remain anonymous.

1.11 Members of the Classification Committee devote several hours every month to the task. This classifications work is an agreed part of a member’s responsibilities and objectives, but members are appointed for their expertise, not because of their present role. The Classifications Team estimates that members typically spend three weeks a year on their committee member duties. The team also estimates that members need about 18 months of classifications work to develop the range of expertise needed to be fully effective in their role.

1.12 Cases are triaged by the Classifications Team with three outcomes:

- “fast track” – where the facts of the case are straightforward and there are no issues in interpreting guidance. Each case is reviewed, and the Classifications Team’s recommendation is signed off by one of the Classification Committee co-chairs. This process happens via email, being linked to a database system. There are typically three or four “fast track” cases every month.

- “delegated case” – cases where more than one option is presented by the Classifications Team, but the recommendation for which of these options to choose is still relatively clear. On such occasions, papers are reviewed by one full member and one trainee member of the committee, who will then endorse the recommendation. On average, there is around one “delegated case” every month.

- “full discussion” – for cases that need full discussion at committee meetings, which are held monthly. Full discussion is appropriate for cases of significant public interest, or where there is anticipated to be a medium or high impact on government debt and deficit figures, or for cases that involve a new or innovative scheme that is precedent-setting. These are the most important cases in terms of impact and reputational risk if an incorrect decision is taken; therefore, they are the most intensely examined. There are typically around two “full discussion” cases per month.

1.13 At Classification Committee meetings, the co-chairs aim to bring all angles of any given full discussion case out into the open; there is an active aim to avoid reaching a consensus too hastily. Everyone is encouraged to contribute their ideas and thoughts, whatever their level of experience.

1.14 The Classification Committee uses the European System of Accounts (ESA) 2010 and the Manual on Government Deficits and Debt (MGDD) 2022, both EU frameworks, as the main references to make classification decisions. These are supplemented with the United Nations’ System of National Accounts 2008. These international frameworks are comprehensive, helping the committee to form a robust rationale behind its recommendations.

1.15 The Director of Macroeconomic and Environmental Statistics and Analysis, signs off on “full decision” cases, a responsibility that is delegated to them by the National Statistician. The co-chairs of the Classification Committee, and the Head of the Classifications Team will provide a written briefing to the director, which will include how clearly the recommendation was reached and the specific aspects that were debated. The director is also briefed orally. Where decisions are finely balanced, the director may ask for more information about individual aspects of the case. Asking the committee to reconsider and re-debate the issue is also an option, though at the time of writing it has not been invoked for several years. The discussions taking place during the sign off are intended to encourage further challenge, rather than being a “rubber stamping” process.

1.16 If a decision cannot be reached, the case will go back to the Classifications Team, with a request for more information. When the UK was an EU member, ONS could also contact Eurostat at this stage for advice and information that could help enable a decision to be reached. In fact, as the UK was bound by EU legislation, it was ultimately Eurostat’s decisions on classifications that were followed in the UK public finance and national accounts statistics in the rare cases where these did not align with the ONS decision.

1.17 When a decision has been approved, the Classifications Team communicates it via Economic statistics sector classification – classification update and forward work plan, a monthly release on the ONS website that sets out the latest month’s decisions. This is being merged with a separate but related release, Recent and upcoming changes to public sector finance statistics, from July 2024. Public sector-related decisions are also recorded in the Public Sector Classification Guide (PSCG). Additionally, there is a letter exchange between ONS and HM Treasury or the relevant devolved administration, explaining the decision in the detail that is necessary for the purposes of government accounting.

1.18 HM Treasury or the relevant devolved administration will use the information ONS provides to notify other government departments and agencies about how the classification decision might affect them. Possible implications might arise, for example, from a budgetary recording perspective, or for their responsibilities in following Managing Public Money requirements. Additionally, the OBR will explain the impact and consequences of major classification decisions for its forecasts or judgements on fiscal sustainability in its public finance publications.

1.19 When it comes to less-regular communications approaches, the highest-profile decisions are often accompanied by a media statement (for example, this one on the reclassification of English Housing Associations as private, non-financial corporations in November 2017), which explains these decisions and the considerations behind them in a less technical manner. Occasionally, the Classifications Team will also issue other articles, for example a compendium of decisions taken during a particular period (such as the financial crisis of 2008 to 2009) or an article translating the guidance on how to distinguish between taxes and fees for sales of service – a common classifications challenge – into more-accessible language and case studies.

1.20 ONS has published a range of published guidance about classifications (such as the PSCG, the Public Sector Finance technical group, the role HM Treasury and Devolved Administrations play and the description of the classifications process). Some of these appear to be outdated in places and would benefit from being updated regularly.

Policy proposals

1.21 HM Treasury and the devolved administrations may also submit policy proposals for classification advice from the ONS Economic Statistics Classification Committee, either on its own behalf if it is the policy lead or on behalf of another department. Policy proposals are forward-looking rather than concerned with existing organisational arrangements or transactions that have already taken place. Such proposals might involve creating a new organisation, restructuring an existing organisation or creating a new type of transaction or financing vehicle or scheme.

1.22 In such cases, ONS is asked to provide classification advice on policy proposals so that the UK Government, or the relevant devolved administration, can understand how these proposals would be treated in the national accounts and therefore take account of the potential consequences for public spending, public revenues and debt measures. To do this in a way commensurate with the remit of the Classification Committee’s role, and ONS’s independence, the committee focuses on the economic statistics classification of the proposed entity or transaction. It does not comment on policy framework or development and remains at arm’s length from policy officials. Likewise, if it proves necessary for ONS to request direct briefing from the proposing department, such briefings will be confined to the factual information required to inform the classification decision.

1.23 Most policy proposals presented to ONS will have a large degree of certainty over the form of the policy and will include all the relevant details to enable the committee to make a “provisional” decision, dependent on the proposal being implemented as described. ONS will not respond to the submission of iterative policy proposals that contain minor amendments, which may be designed to achieve a certain classification outcome. If the circumstances change, it is the responsibility of the proposing department to inform ONS via the intermediary managing the request (HM Treasury typically, or one of the devolved administrations). Whether a change is made or not, once the policy has been implemented, it will still be subject to the full classifications process in its final form, and a final classifications decision for the policy will then be taken and published.

1.24 On rare occasions, government departments might seek a view on a proposal at an early stage of development. In such cases, ONS will provide indicative, provisional advice on the expected classification of the proposal, based on information available at the time. However, a final decision will not be reached until the policy is implemented. In the interim, ONS will only consider alternative versions of the same proposal exceptionally and if substantial and significant changes have been made. Any explanatory article published on the final implemented policy will note how many versions of the proposal ONS considered. Final classification decisions will be published when the policy has been announced or implemented by the government.

1.25 In terms of communicating policy proposal advice, ONS does not publish or otherwise make publicly available details of classifications advice in respect of policy proposals, except where they may be discussed in a supplementary article published once a final classification decision has been announced.

Implementation of a classification decision

1.26 Once a classification decision has been reached and communicated, the responsibility for implementing it moves beyond the ONS Economic Statistics Classifications Team, although the team does retain some role in communicating the implementation to affected users.

1.27 Coordinating the implementation of classification decisions in the UK National Accounts falls to the ONS Implementation Committee. The Implementation Committee must consider how the decision would flow through the various statistics related to the UK National Accounts and must strike a careful balance between implementing decisions as quickly as possible and doing this in a way that is consistent and groups similar changes.

1.28 Some classification decisions are complex to implement. Such decisions will also often require the involvement of the ONS Economic Statistics Methodology Advisory Committee (MAC). The MAC will consider these complex cases and come to a decision on how best to apply a decision.

1.29 Finally, a Public Sector Finance Revisions group meets monthly to consider revisions to the Public Sector Finance statistics, including those resulting from the implementation of classification decisions. This is a separate process to the one used for UK National Accounts revisions, though there is some overlap.

The National Statistician’s Committee for Advice on Standards for Economic Statistics (NSCASE)

1.30 In 2022, the National Statistician’s Committee for Advice on Standards for Economic Statistics, or NSCASE, was set up. According to its Terms of Reference, published in November 2022, its role is to “support the National Statistician in ensuring its processes for influencing, adopting, and monitoring progress against international statistical standards are of a high standard.”

1.31 So far, the Classifications Team has taken papers to NSCASE on the adoption of a Eurostat Clarification Note on Public-Private Partnerships and on the adoption of the Manual on Government Deficit and Debt – Implementation of ESA 2010: 2022 Edition. The latter is an important manual to follow for classifications decisions. The adoption of both the Clarification Note and the MGDD 2022 was supported by NSCASE, and the National Statistician’s approval of these decisions was published on the UK Statistics Authority (UKSA) website in September 2023.

Management of stakeholder relationships

1.32 Classification decisions are important because of their impact on deficit and debt figures, which in turn have implications for fiscal rules and government spending decisions and the day-to-day management of public money. These are matters that will have repercussions for everyone to some extent, but in particular directly affected stakeholders.

1.33 These key stakeholders include HM Treasury, the Scottish Government, the Welsh Government, the Northern Ireland Executive, OBR and the Bank of England.

1.34 The Classifications Team meets with HM Treasury weekly; meetings with each of the devolved administrations are held monthly; and there is also a quarterly Classifications Forum for all five parties. Separate quarterly meetings are held with the Bank of England, wherein the latest classification decisions are presented and any questions answered. OBR attends a monthly meeting about revisions to the public sector finance statistics more broadly but does not have a standing meeting specifically with the Classifications Team.

1.35 The Classifications Team may also meet with other government departments and public bodies, especially when a specific department or public body has made, or is planning to make, a classification request. The request will be made via HM Treasury, or one of the devolved administrations, and they will play an important role in the process, making sure key information is transferred between the department and the Classifications Team. However, for the most complex cases, the Classifications Team will meet with the department or public body directly during key stages of the process to fully understand the request being made and for relationship management more broadly.

1.36 The team also maintains strong relationships with the producers of the UK National Accounts and producers of statistics on public sector finances and public sector employment. These relationships are mostly coordinated via the ONS Implementation Committee, a forum for selected official statistics producers from ONS who discuss how to implement the classifications decisions across the suite of economic statistics. The team engages separately with statistical producers outside of ONS affected by classification decisions, for example HM Treasury, as joint-producers on public sector finances.

1.37 The Classifications Team also engages with the Economic Statistics Methodology Advisory Committee, which discusses best-practice methodology in economics statistics. Although these two committees are separate entities, they worked together closely during the COVID-19 pandemic and have collaborated occasionally thereafter.

The approach of other National Statistical Institutes

1.38 Classifications decisions involving public sector finances are often the responsibility of the national statistical institutes, either exclusively or in collaboration with other government departments. In some countries, however, the finance ministry has responsibility for the role. Most countries outside the EU follow the guidance from the UN System of National Accounts or the IMF Government Finance Statistics Manual; some may supplement these with national guidance. For example, in South Africa, decisions on the classification of government and public units are made by a committee comprising three agencies: Statistics SA, the South African Reserve Bank and the Treasury. However, unlike the UK, which has a harmonised Government Finance Statistics system where compilers of the national accounts and practical day-to-day managers of public money use the same underlying public finance data, in most non-EU countries, each institution uses a different framework. In Canada, Statistics Canada decides on the classification by institutional sector of each government and public unit. The information is shared with federal and provincial governments for feedback to confirm that significant factors have been considered. In Australia, the Australian Bureau of Statistics is responsible for the classification of units in official statistics, using guidance from national and international statistical manuals. Statistics NZ has adopted an approach of targeting intervention, providing active input where it has the expertise and resources to provide the most impact.

Back to top