Findings

Introduction

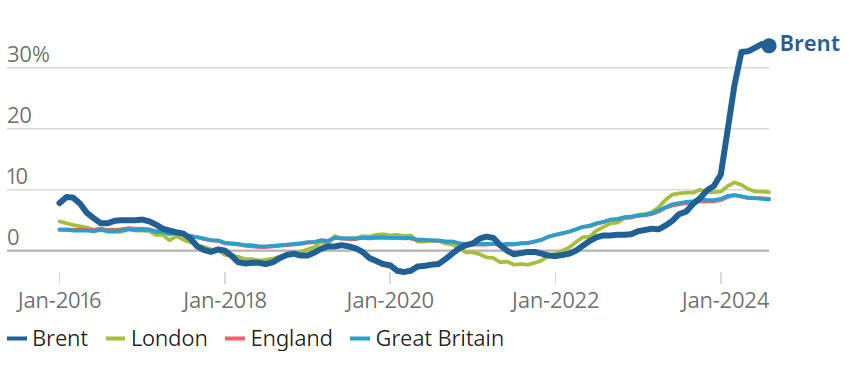

1.1 Published by Office for National Statistics (ONS) since March 2024, the Price Index of Private Rents (PIPR) is a monthly series of official statistics in development that provides a detailed overview of private sector rent levels in Great Britain (GB) (as seen in Figure 1). PIPR provides estimates of private rental prices by property type and bedroom category. The estimates are comparable over time, and available down to local authority area in England and Wales and Broad Rental Market Area (BRMA) level in Scotland.

Figure 1: Private rental and house price annual inflation, UK.

Source: ONS Private rent and house prices, UK: September 2024

1.2 ONS has developed PIPR to overcome known limitations of its previous private rental sector statistics, which were unable to provide estimates of private rent levels and change that were both comparable over time and available at low levels of geography. These limitations were previously identified in the UK Statistics Authority (UKSA)’s Systemic Review on Housing and Planning Statistics in 2017. As a result, PIPR has now replaced ONS’s Index of Private Housing Rental Prices (IPHRP) and Private Rental Market Statistics (PRMS).

1.3 PIPR estimates currently cover GB, with estimates for NI and UK planned for publication from March 2025. Estimates of private rents inflation for NI are therefore currently still calculated using the IPHRP method. An important use of PIPR data is replacing IPHRP data for estimating the owner occupiers’ housing costs (OOH) element of the Consumer Prices Index including OOH (CPIH).

1.4 While PIPR uses private rents data from the same underlying sources as the IPHRP series, ONS states that PIPR makes better use of the existing data sources, improved methods and newly developed systems. Whereas ONS was only able to use aggregate data for IPHRP, for PIPR it draws on more-detailed rents microdata for England and Wales and uses new methods of measuring rental prices. ONS combines the rents microdata with property attributes data using a hedonic regression model. This method is different from that used for the IPHRP series, which used a matched-pairs approach and, consequently, less than half the volume of private rents information each month. Being able to draw on more information has allowed ONS to produce private rents estimates at lower levels of geography, increasing their value for local housing market analysis.

Back to topPIPR methods development

1.5 ONS began researching existing methodologies used for rental prices statistics and developing the PIPR methodology in 2019. ONS set out to produce a ‘stock’ measure of private rents that reflected both newly agreed rents coming on to the market and rents levels paid by existing tenants that were agreed in previous months. ONS engaged with stakeholders, such as the Advisory Panels for Consumer Prices, and with international experts in property price statistics, including members from the Economic Statistics Centre of Excellence (ESCoE). The team overseeing these developments then worked closely with ONS methodology experts to quality-assure multiple aspects of the methodology.

1.6 The PIPR methodology uses a hedonic regression model, which is similar to the approach used to calculate the UK House Price Index (HPI), with the exact methodology tailored to suit the rental data. This is an internationally recognised method described in Chapter 5 of the Eurostat Handbook on Residential Property Price Indices: Hedonic Regression Methods. The basic principle of this method is to predict monthly changes in the rental prices for a fixed annual basket of properties. This fixed set of properties is updated annually to represent the changing stock of rental properties. Table 1 sets out PIPR’s main features and methods alongside those of the IPHRP and PRMS series that it has replaced.

Main features and methods of PIPR, IPHRP and PRMS

Source: ONS PIPR, IPHRP and PRMS Quality and Methodology Information

Price Index of Private Rents (PIPR) Features/Methods:

Coverage:

GB (UK planned from March 2025)

Monthly sample of agreed rental contracts for new and existing tenants in England and Wales: 85% new advertised and 15% agreed rents in Scotland; 100% new advertised’ rents in NI.

Key Features:

Monthly private rental price indices and rent levels based on weighted geometric mean – available by property type and bedroom category, in GB nation, local authority in England and Wales, and BRMA in Scotland.

Comparable over time and responsive to changes in the rental market.

Sampling Approach:

Fixed sample of tenancies drawn annually based on records collected over the previous 12 months. Stratifies at a low geographical level so data are more representative of the UK rental market, and better represent geographical areas that are under-collected compared with other geographical areas.

Makes use of all available data collected (around 500,000 rents annually).

Estimation Method

Price assumed to be valid for 14 months from its entry date into the system, or until an update is received. If no price update is made in the 14-month period, it is removed from the sample.

Fixed annual basket of properties created.

Rental price data linked to property characteristics data.

Monthly data fitted to a hedonic regression model to quantify the relationships between property characteristics and rental prices.

Predicted prices for properties within the fixed basket calculated using model coefficients.

Weighting:

Estimates are weighted and chain-linked annually to produce a rental price index series over time.

Dwelling stock weights used to adjust estimates for geographical areas that are under-collected compared with other geographical areas.

Quality Assurance:

Quality assurance checks completed on the monthly rents data. Data cleaning conducted by Ulster University for Northern Ireland data.

Unexpected movements within the series are explored through the record-level data. Monthly curiosity meetings are held to review the data and discuss any long-term trends and their drivers.

Reports and metrics are analysed to ensure sample remains within acceptable quality parameters.

IPHRP Features/Methods:

Coverage:

UK

Monthly sample of agreed rental contracts for new and existing tenants in England and Wales: 85% new advertised and 15% agreed rents in Scotland; 100% new advertised rents in NI.

Key Features:

Monthly private rental price indices based on weighted geometric mean – available by UK nation and English region.

Comparable index only – does not provide mean/median rental price rent level estimates.

Sampling Approach:

Stratifies like PIPR (by region, type of property and furnished status) but at a higher geographical level.

Uses half of the records collected over the previous 14 months.

Splits the data between a sample of around 300,000 UK rents annually (used to calculate the indices) and a substitution pool as part of the matched-pairs methodology.

Estimation Method:

Price assumed to be valid for 14 months from its entry date into the system, or until an update is received. If no price update is made in the 14-month period, it is removed from the sample and a replacement property is sought from the substitution pool.

Sample of properties monitored for price changes throughout the year by matching records (matched-pairs) collected each month by rent officers to the existing sample.

Weighting:

Dwelling stock weights used to adjust estimates for geographical areas that are under-collected compared with other geographical areas.

Quality Assurance:

Quality assurance checks completed on the monthly rents data. Data cleaning conducted by Ulster University for Northern Ireland data.

Unexpected movements within the series are explored through the record-level data. Monthly curiosity meetings are held to review the data and discuss any long-term trends and their drivers.

Reports and metrics are analysed to ensure sample remains within acceptable quality parameters.

PRMS Features/Methods:

Coverage:

England

12-month sample of agreed rental contracts for new and existing tenants in England.

Key Features:

Annual private rental price rent levels based on unweighted median (plus upper and lower quartiles) – by property type and bedroom category, English region and English local authority.

Estimates not comparable over time.

Sampling Approach:

Based on a 12-month sample of around 460,000 English private rents from in the VOA lettings information database.

Uses all rental transaction data, but limitations prevent compositional changes from being considered, so unusable for an index or time series.

Estimation Method:

Median, upper and lower quartile range estimates calculated by administrative area and by bedroom or room category. Rental value ranges in interactive map of rent price by local authority and bedroom category produced using ‘Jenks natural breaks’ method.

This method separates values into groups that are naturally present in the data by seeking to reduce variance within classes and maximise variance between classes.

Weighting:

Unweighted.

Quality Assurance:

Checks carried out on the lettings information database, including ensuring benefits–funded tenants and small sample sizes are removed.

1.7 Following the PIPR methodology, when a rental price is collected for a property, it will be assumed to be valid for 14 months and kept constant from its entry date into the system (because most tenants are in some form of long-term agreement) unless an updated price is collected for the same property within those 14 months. ONS states that it uses a 14-month validity period as it balances typical contract lengths, which tend to be either 6, 12, 18 or 24 months, with the period that rent officers’ attempt to collect updated rents information for specific tenancies. Rent officers in England and Wales attempt to re-collect updated rents data for the same properties within the 14-month period. Where the price of a property is updated multiple times over this period, the most recently collected price will be used so that the latest record for each property is used and each property has only one record in the data. ONS told us that a common misunderstanding by some users is that rental prices are smoothed over the 14-month period by taking an average. ONS said that it would make it clear that this is not the case in its published documentation.

1.8 Fourteen months is the same validity period as previously used for IPHRP. ONS published an experimental analysis in 2023 based on the subset of IPHRP rental properties that received updated rental price data within 14 months of the previous data collection for the same property. This analysis showed that the median length of time between rent officer visits was 12 months for England and 9 months for Wales. Despite the analysis indicating that a 12-month validity period on average might be sufficient, ONS told us that using the 14-month window allows rent officers in England additional time to attempt to re-collect updated rents data for specific properties. The 14-month window increased the number of price changes that are captured for a given period that would otherwise be omitted from the rolling sample, if a shorter time period were used. Using a shorter time period could then potentially lead to volatility in the sample composition if the same properties kept falling out of the sample due to rent officers not having revisited within that period.

1.9 ONS told us that it had reviewed the 14-month validity period three times previously, including with its technical panel. The conclusion each time was that the benefit of the 14-month window for reducing the impact of potential composition changes outweighed the benefit of a 12-month window for aligning with estimates of average contract length. It therefore provided a better balance between the time that rent prices are likely to remain unchanged with the period that rent officers’ attempt to collect updated rents information for specific tenancies.

1.10 Compared with England and Wales, Scotland and NI have policy and operational differences which mean that there is little active follow-up by rent officers during the 14-month validity period in Scotland, and none at all in Northern Ireland, owing to PIPR estimates being based on 85% advertised rents data in Scotland, and 100% advertised rents data in NI. However, ONS told us that in practice, some additional follow-up does happen organically as part of rent officers’ operational processes and the PIPR sample methodology. Around a third of PIPR’s rent price updates for Scotland come from previously advertised tenancies ending and the same properties being re-advertised and their rental prices being captured within the 14-month validity period. ONS told us that a substantial proportion of rental price updates for NI are also based on the same rental properties that are subsequently re-advertised within the 14-month validity period. These differences were the same for the previous IPHRP series.

1.11 Once collected, the latest available rental price for a given property is used to produce the latest month’s PIPR estimate (either an updated price collected in the latest month, or the latest price for that property recorded within the last 14 months). This practice enables ONS to produce monthly ‘stock-based’ rental price estimates using the latest rents information received for the stock of privately rented properties.

1.12 While PIPR aims to reflect the ‘stock’ of all rents, not just the ‘flow’ of newly taken-up tenancies and renewals, several users told us that they would welcome ONS producing an additional measure based on the ‘flow’ of new rents, alongside PIPR’s ‘stock’-based measure. Other users that we spoke to argued that PIPR (and IPHRP previously) produces lagged estimates of rental price inflation due to the stock-based estimation approach used. These users argued for an alternative flow measure based on new lets (or newly re-let properties) in a given month only, the estimates for which would likely be higher than PIPR’s stock measure as rents rise, and lower as rents fall.

1.13 An ONS blog post based on the previous IPHRP series acknowledges that a delay in rental price changes feeding through to private rents measures is likely when using a stock-based approach instead of a flow approach. Such delays are expected as landlords cannot change the rental price for long-term tenants immediately:

Due to the difference in how the various rental indices are measured, the IPHRP tends to lag the private measures by around 6 months […]. As a stock-based measure, this is what we would expect IPHRP to show – landlords are unable to simply change the rental price for a long-term tenant, so it takes time to feed through.

1.14 As ONS states in the PIPR statistics, it is not currently possible to reliably create a flow measure of private rental inflation with the available rents data. ONS told us that it investigated the feasibility of producing a measure of the ‘flow’ of new rents alone, but concluded that this was not currently possible. Data suppliers that we spoke to in England and Wales also told us that it would not be possible to accurately disaggregate the flow of new rents from the broader stock of rents data that they collect. Such a measure would also be based on a much smaller dataset of monthly rental prices. It is therefore not currently feasible to produce such a measure. PIPR’s stock-based approach also seems more appropriate as it estimates ‘average’ rental price changes for the entire private rented sector population each month, not only rents that have been newly agreed or renewed.

1.15 The operational differences in the data collected for Scotland and NI mean that PIPR estimates for these nations are largely based on newly advertised rents, which tend to be higher and more representative of the ‘flow’ of new rents than the ‘stock’ estimates of all rented properties in England and Wales. Differences in the proportions of advertised, newly agreed, newly re-let and existing rents data that are used to produce PIPR national, regional and local estimates each month risk limiting their comparability, especially in terms of comparing Scottish and NI estimates with those for England and Wales.

1.16 ONS told us that such a risk is mitigated by the use of a common stock methodology across the four nations, and the approach used is the best that it can be given the differences and limitations of the data collected across the four nations. However, ONS’s published methods information does not clearly explain how PIPR methods mitigate this risk. It is also not clear what the ideal profile of newly agreed, newly re-let and existing rents data should be each month to best represent the rents paid across the UK private rented sector population. The available data does not currently allow for a full understanding of this profile.

1.17 ONS adjusts its monthly PIPR estimates using expenditure weights that it calculates on an annual basis, to ensure that PIPR estimates are representative of the UK private rental sector stock. To calculate the weights, dwelling stock data are multiplied by average rental prices. The dwelling stock data come from the ONS, Ministry of Housing Communities & Local Government (MHCLG), Scottish Government (SG), Welsh Government (WG), Department of Finance Northern Ireland (DoF) and Northern Ireland Housing Executive (NIHE).

1.18 Dwelling stock estimates are split by the proportion of property types rented privately in the nine regions of England using data from the English Housing Survey and equivalent sources for Wales and Scotland. This approach is largely the same as that used for the previous IPHRP series, but at a lower geographic level. ONS publishes a basic overview of how the weights are calculated, their relative strengths and limitations and the rationale for the sources chosen.

Back to topQuality of rents data

ONS should publish metadata on the quality of PIPR rents data

1.19 Private rents data are not available for all the roughly 5 million privately rented properties in the UK, nor are data available for every month for a given property in the available sample of properties. ONS is therefore not able to estimate the proportion of all rented dwellings where a price has changed in the latest month. Instead, ONS estimates the proportion of rented dwellings that have experienced a price change ‘recently,’ though it is unable to identify exactly which month a price change occurred within the 14-month period.

1.20 The Valuation Office Agency (VOA), Scottish Government, Welsh Government and NIHE deploy rent officers to collect information each year on the prices paid for a large sample of privately rented properties for properties with different numbers of bedrooms, across a spread of BRMAs. BRMAs are areas within which a person might reasonably be expected to live, taking into account access to local facilities and services, and can incorporate multiple local areas. Rent officers aim to collect a range of rents information annually for the primary purpose of setting Local Housing Allowance (LHA) rates, which inform the Department of Work and Pensions Housing Benefit levels that are payable in each area.

1.21 The sample is purposively collected between October and the following September, to meet annual collection targets for properties with different numbers of bedrooms in each BRMA. ONS has agreements with the various agencies to provide it with a monthly subset of the data collected. Data collection by rent officers is most established in England and Wales. Annually, 450,000 private rents prices are collected by VOA rent officers in England, 30,000 in Wales by the Welsh Government, 25,000 in Scotland by the Scottish Government and 15,000 in NI by the NIHE. NI data are based largely on data provided by propertynews.com.

1.22 Rents data collection is challenging as letting agents and landlords provide data to rent officers on a voluntary and goodwill basis. The ability of rent officers to collect rents data or follow up to record price changes is determined by their local contexts and resources. As a result, data collection may be harder when agents or landlords are busy or when goodwill is in short supply, including for reasons related to the private rental sector policies of individual devolved governments.

1.23 As previously discussed, due to the different operational and policy contexts across the UK, there is significant variation in the quality of source data between different UK nations, especially for Scotland and NI. Data for these two nations are predominantly based on advertised rents, which tend to be higher than actual agreed rents. There is also a smaller active follow-up over time to assess price changes over a 14-month period in Scotland than in England and Wales and no active follow-up in NI. However, ONS told us that both countries will experience some follow-up organically as part of their data collection processes (around a third of Scotland’s properties end up being followed up, actively or organically). ONS told us that despite NI data being based on advertised new lets, it receives a substantial number of price updates for the same property when the same let is re-advertised within 14 months.

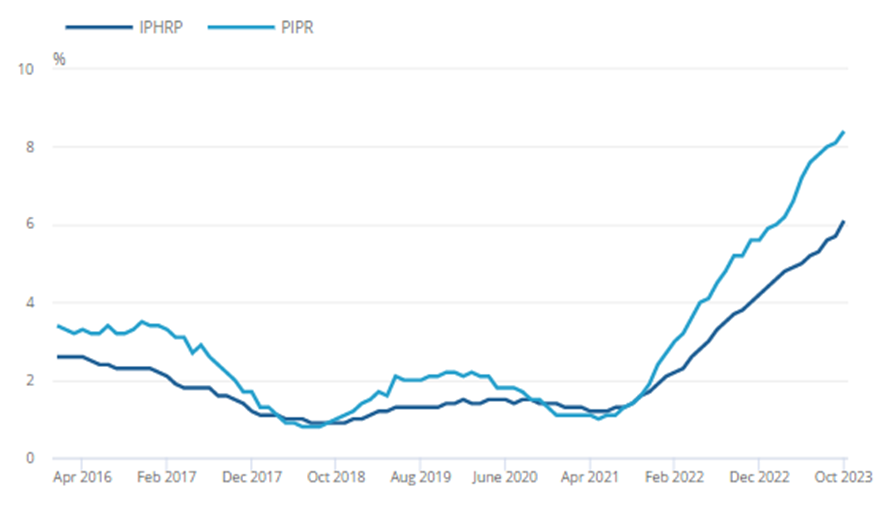

Figure 2: Private rental price inflation, PIPR for GB and IPHRP for NI, January 2016 to June 2024

Source: ONS Private rent and house prices, UK: September 2024

1.24 Despite the inclusion of some specific caveats in the PIPR bulletin, differences in data definitions have led to concerns about comparing rents estimates for England and Wales with estimates for Scotland, due to the Scottish source data being mostly based on an advertised basis and so generally higher than agreed rents. The Scottish Government told us that these differences leave PIPR estimates open to inappropriate and misleading comparisons between rates of rent increases between the different UK nations (Figure 2 shows that PIPR private rental inflation for Scotland tends to be higher than for England and Wales).

1.25 These differences are a particularly pertinent issue for Scotland due to its policy on rent controls that restricted in-tenancy rent increases between late 2022 and mid-2024, under the Cost of Living (Tenant Protection) (Scotland) Act 2022. The Scottish Government was concerned that PIPR overestimates Scottish rents over this period due to a lack of data on existing rents being included in PIPR’s stock measure, with PIPR-based national comparisons cited in oral debates in the Scottish Parliament. The Scottish Government told us that its preference would be for ONS to revisit the PIPR methods for Scotland due to the data differences compared to England and Wales. ONS told us that discussions at a stakeholder engagement event with users in Scotland acknowledged that PIPR estimates for Scotland were predominantly based on advertised rental data rather than actual rents. However, the primary need was to improve rents data collection in Scotland to address the issue.

1.26 ONS states in its published quality information that to combat potential bias in the data submitted each month, rent officers seek to achieve monthly rental data targets in line with census data totals for local private rents. However, ONS has no influence on rent officers’ targets, and it is not clear to what extent they are achieved by rent officers who are primarily focused on collecting data annually for the purpose of setting Local Housing Allowance (LHA). It is also not clear how the data used to create local rent profiles will be updated between census years.

1.27 Rent officers that we spoke to told us that the annual October-to-September LHA collection period tended to create a busier period leading up to the year end in September as rent officers sought to meet annual targets, with a quieter month in October. We also heard evidence that a large proportion of small landlords (those with one or two properties) may not be included in the PIPR estimates as they are hard for rent officers to engage with. VOA told us that it has plans to improve data collection from this hard-to-reach population in England, but data suppliers in the other UK nations had no plans to introduce similar initiatives.

1.28 There may also be inherent lags in the rents data being submitted, with the PIPR estimates representing changes that may have happened at a time point between when the data were supplied and the rental price actually changing, as was also the case for IPHRP. For example, we heard that large letting agents will typically submit bulk data submissions once every few months, which may mean that rents changes that occurred in a previous month were not captured in the PIPR estimate in the relevant period. For these data, ONS has no direct indication of when a rental price change occurred, and so the change will be reflected in the PIPR estimate for the month in which it is received, with the updated price being potentially retained for the next 14 months.

1.29 In the course of time, ONS needs to understand the nature and extent of any lags within the source data, including whether such lags tend to introduce bias in particular geographical areas, and communicate their potential impact on the accuracy of PIPR estimates. However, ONS told us that the source data does not include the information required to understand the extent of any potential lags and it has no way of knowing precisely when a price change occurs to analyse any potential impact.

1.30 Despite these challenges to data quality, ONS has good relationships and effective communication channels with its data suppliers, who report positive engagement with ONS and are aware of how their data are being used.

1.31 Data quality could be improved if landlords and agents were required to supply rental price information to rent officers on a mandatory basis. However, mandatory rental data requirements for landlords would also depend on legislative changes taking place in each UK nation, and may lead to unforeseen impacts on data quality due to changes in data collection dynamics and processes.

1.32 There are long-term plans to further develop rents data collection and draw on administrative sources, but these are anticipated to be rolled out over a long time period and are outside ONS’s control. For example, the UK Government recently announced plans for creating a national digital private rented sector database of landlords and their properties as part of the draft Renters Rights Bill. Such a database could have potential as a useful new data source.

1.33 The potential for significant variations in source data quality is likely to lead to reduced quality in monthly estimates, especially at local levels of geography. Some quality information is published alongside granular PIPR estimates to support their appropriate use. For example, ONS has provided clear caveats since April 2024 following a bulk data submission from a large new data supplier in Brent that led to a sharp increase in the estimated average private rental price for Brent (see Figure 3). However, more general detail on the quality of the PIPR source data, especially monthly metadata supplemented by periodic extra information, would help support the appropriate interpretation and use of the PIPR statistics.

Figure 3: Private rental price annual inflation, Brent, January 2016 to August 2024

Chart showing private rental price annual inflation in Brent, from January 2016 to August 2024. The chart shows that private rental price annual inflation for Brent, London, England and Great Britain followed a similar trend until February 2024. Estimates for Brent then increased to over 30% between April 2024 and August 2024, while estimates for the other three areas continued to follow a similar trend at around 10%.

Source: Price Index of Private Rents, Local housing statistics tool, ONS

1.34 ONS does not currently publish metadata on the quality and representativeness of the private rents data that PIPR estimates are based on each month, for which quality issues at low levels of geography are likely. Given the apparent limitations of the source data, including that they are primarily collected for operational purposes with variations in the type, quality and volume of rents data supplied by the different UK nations and at local levels over the year, additional information is needed to understand the quality of the source data used to produce monthly PIPR estimates.

Requirement 1: In the context of the purposive sampling approach used; variations in the types, volume and spread of local rents data supplied over the year across the UK nations; and the potential bulk data submissions and lags in recording rental price changes, ONS should:

- publish a detailed account of the quality and representativeness of the private rents data that PIPR estimates are based on each month, in relation to types of data collected where possible (agreed vs advertised) by property type and geography

- publish additional information on its approach to assessing the quality and representativeness of the private rents data each month, including the extent to which the rents data submitted meet expected monthly volumes

Publishing this information should provide insight to users about the quality of PIPR source data and enable a more meaningful understanding of variations in rent data quality and the approaches that ONS statisticians take to identify and highlight data quality issues, which are particularly likely to impact PIPR estimates at low levels of geography.

Back to topPublishing methods and quality information

ONS should improve PIPR’s published methods and quality information

1.35 ONS published a Quality and Methodology Information (QMI) document and information on the Quality Assurance of Administrative Data (QAAD) about these statistics. The QAAD document sets out data collection and supply in more detail, including the nature of collection and supply, agreements in place, engagement, quality checks and validation. ONS is fairly open about the limitations of the data in their own contexts. However, it is not clear what these limitations mean for the estimates or how they should or should not be used, particularly at local levels. ONS applied OSR’s Quality of Administrative Data Toolkit to produce the QAAD document. However, it has scored most sources as having a low level of risk due to their overall weight in the index, rather than basing this score on an assessment of the quality of the data sources themselves.

1.36 Some users told us that they liked the QMI as it provided all the information that they needed. However, other users did not like the presentation of the QMI as it currently seems to fall between technical and non-technical uses. Some users reported that they consider that it was neither technical enough for expert users, nor straightforward enough for non-expert users. Technical users would also benefit from ‘first principles’ explanations of why certain analytical decisions and approaches have been reached, rather than just a description of what is done. Including worked examples to better explain how the methodology works would also be beneficial.

1.37 Regarding the suite of published outputs more broadly, ONS should communicate any caveats more clearly and consistently across the range of PIPR outputs to ensure that important limitations are not missed. The limitations and potential uncertainties highlighted in the QMI are not as evident as they might be if they were included in the caveats of the main bulletin and the tables. Such clarity is especially required in the dissemination of Scottish and Northern Irish data. Some caveats are given in detailed notes, but these need to be strengthened and more clearly and consistently communicated across the range of outputs. The following cases are presented as examples:

- There are some caveats and footnotes surrounding the comparability issues for the Scotland and NI estimates, which can be useful. However, these explanations could be overlooked depending on where they are located in the outputs. For example, the data tables did not initially include caveats about Scotland comparability issues.

- Some of the guidance around specific limitations advises that users should ‘use caution’ when interpreting the data. However, specifying exactly how the presented data can be appropriately used would be more helpful.

- The local housing tool provides some guidance to users on the volatility of local estimates to support appropriate use. However, the guidance in the QMI on local estimates appears to urge a higher degree of caution.

- The bulletin presents a UK total up front with all constituent UK nations together on one chart and labels UK chart entries as “PIPR.” However, the QMI stresses that PIPR covers only GB, while NI estimates are still based on IPHRP. The rationale for publishing estimates for the different UK nations together and producing a UK total based on a combination of PIPR and IPHRP, and any related limitations of this approach, need to be clearly explained up front.

1.38 In light of the above examples, ONS needs to improve its communication of methods, quality and uncertainty information to support the appropriate interpretation of PIPR estimates across the full range of PIPR products, whichever product users access. ONS has included a caveat in the dataset to explain why the Scottish data are not directly comparable. It should also update its caveats for the Scottish and NI issues in the graphs and charts to ensure that they are more complete, and users are suitably informed of their relevant strengths and limitations.

1.39 There is also limited published information on some aspects of the methods choices, for example, how the weights are calculated, their relative strengths and limitations and the rationale for the sources chosen. Some users also questioned the robustness of ONS’s current method for chain-linking PIPR to IPHRP estimates from 2005 to 2015 to create a longer historical back series. ONS told us that this was a standard methods approach used across its consumer price indices. However, users told us that they were unsure whether the method is sound and unclear about the limitations of the approach used, as ONS has not published information on the chain-linking method.

1.40 In relation to ONS’s approach to revising PIPR data, ONS includes a brief description of its revisions policy in the bulletin regarding the incorporation of NI data:

“Northern Ireland rents data are not available for the latest two months. To produce provisional UK statistics, Great Britain’s inflation rate for the latest two months has been used to estimate Northern Ireland’s inflation rate in this period. Each subsequent month updated Northern Ireland data are used to revise estimates for the UK. This means that there is a two-month revision period for the UK series in PIPR.”

1.41 ONS has not published a full explanation of the methods used to estimate the provisional UK estimate to how subsequent revisions are implemented in practice. Some users were also unsure about differences in ONS’s revisions policies for its different consumer prices publications. ONS should consider including a fuller account of the methods it uses to estimate and revise UK totals when it receives the NI estimates belatedly, and a statement explaining that although it revises UK PIPR estimates, its policy is not to revise its other consumer prices publications that draw on PIPR data retrospectively.

1.42 ONS told us that it is open to improving its published methods and quality information. We recognise that ONS’s publication systems have some restrictions, but ONS needs to find a way to overcome such obstacles to making improvements that support a full and appropriate interpretation of PIPR methods and quality for a range of users and uses. ONS told us that it hoped that these could be addressed in the medium term by the planned transformation of the ONS website.

Requirement 2: Given the complexity of the methods chosen and variations in source data quality across the nations and over the year, ONS should publish more-detailed and accessible information on PIPR methods and quality to allow a complete understanding of the approaches taken and support their appropriate interpretation for a range of users and uses. In publishing this, ONS should:

- improve its communication of the quality of and uncertainty in the PIPR estimates, including sufficiently detailed information for expert users; having shorter accessible explanations with worked examples for non-expert users; and ensuring greater consistency in the communication of key methods and quality information across the different PIPR products

- be clear about how the PIPR methodology works for the different source data used, including, for example, rents source data being on predominantly on an advertised basis in Scotland, and completely on an advertised basis in NI. ONS should be clear about why the same method is used even though the data sources differ

- set out in more detail aspects of the methods choices made, including, for example, how the PIPR weights are calculated; the rationale for the data sources chosen to weight PIPR estimates; the chain-linking methods approach used to combine the PIPR and historical IPHRP series; and the relative strengths and limitations of these methods

- provide a clearer rationale for choices made, for example, combining PIPR and IPHRP estimates in the presented UK totals, and clear guidance on the extent of comparability of estimates for the different UK nations

- provide a fuller explanation of its approach to revising provisional UK PIPR estimates owing to NI data only becoming available two months after GB data. This will support a more transparent user understanding of the nature and extent of revisions made to PIPR estimates and make it clear that these are the only revisions made

Owner occupiers’ housing costs (OOH)

PIPR’s measure of owner occupiers’ housing costs (OOH) is more responsive to inflationary change, but ONS should monitor its ongoing suitability

1.43 An important use of PIPR data is replacing IPHRP data for calculating the owner occupiers’ housing costs (OOH) element of the Consumer Prices Index including OOH (CPIH). The use of rents data to estimate the housing costs of equivalent rented properties in the private sector is called the ‘rental equivalence’ approach.

1.44 In relation to the suitability of PIPR data for measuring OOH, users told us that PIPR was seen to be more responsive to inflationary changes than the previous IPHRP series. Users also told us that the headline PIPR series seemed to be at a more realistic level than IPHRP, which they said was widely considered to be insufficiently responsive to inflationary changes in rental prices and particularly to known increases in recent years.

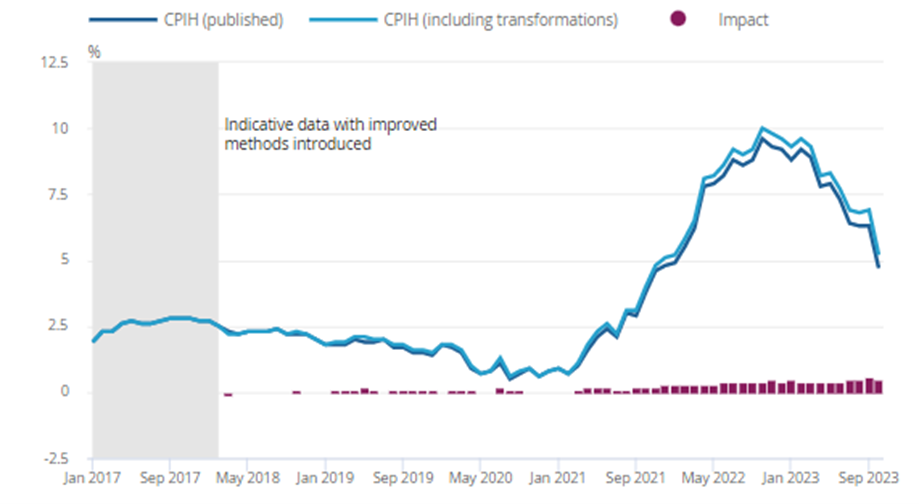

Figure 4: Private rental price annual change for the UK, January 2016 to October 2023

Source: ONS, Redevelopment of private rental prices statistics, impact analysis, UK: December 2023

1.45 Figure 4 was taken from ONS’s Redevelopment of private rental prices statistics, impact analysis. It shows how PIPR’s recent private rental price annual percentage change follows a similar trend to IPHRP’s, but was generally higher.

Figure 5: Indicative impact of transformed private rents and second-hand cars indices on CPIH 12-month rate, UK, January 2017 to October 2023

Chart showing impact of transformed private rents and second-hand cars indices on CPIH 12-month rate, UK, from January 2017 to October 2023. The average indicative impact to the CPIH annual rate of change was 0.2 percentage points, which was mostly influenced by changes in measuring private rental prices.

Source: ONS, Impact analysis on transformation of UK consumer price statistics: private rents and second-hand cars, December 2023

1.46 Figure 5 was taken from ONS’s Impact analysis on transformation of UK consumer price statistics: private rents and second-hand cars. It presents the impact of PIPR’s higher estimates on CPIH. ONS notes that PIPR had a much larger impact on CPIH than the change introduced in parallel for second-hand cars.

1.47 Given the importance of PIPR-based estimates of OOH in CPIH, and as they have been included only since March 2024, it is important that ONS continue to assess and monitor the suitability of PIPR-based estimates of OOH for CPIH, especially as it addresses the requirements in this assessment report. In particular, ONS should seek to understand the extent to which any potential lag in the private rents data that it receives in terms of bulk data submissions from large lettings agents could affect PIPR’s suitability for measuring OOH.

Back to topUser engagement approach

ONS engaged openly and effectively as it developed PIPR, but it has not set out its future user engagement approach

1.48 ONS took an open and transparent approach to PIPR’s development, with a development plan, methodology and impact analyses published in advance of the first publication. ONS held various public events with a range of different users and stakeholders during the development process. ONS’s Stakeholder and Technical panels on consumer prices also provided good opportunities for external challenge to ONS’s approach to developing PIPR. It also had quarterly meetings with Statistics New Zealand and the Australian Bureau of Statistics to discuss how they measure rental prices, and had similar discussions with Statistics Canada and Land and Property Service (NI).

1.49 ONS also ran a series of public engagement events to trial the changes in late 2023. It ran public webinars with users to show them how to use the new statistics; held teach-in sessions with governmental departments and data suppliers; held internal communications with wider ONS teams; and released briefings, blog posts and forums on the PIPR development plan, methodology and impact analyses. ONS was open about its plans, priorities and progress and what it considered it was and was not able to do in relation to user requests raised during the external events.

1.50 Feedback from many of the users that we spoke to indicated that ONS’s engagement around PIPR’s development was open, positive and helpful. The range of resources ONS has produced and its efforts to engage with a wide range of users ahead of PIPR’s initial publication were extensive. This engagement approach may be a good model for ONS to use ahead of launching other future statistics developments. At the same time, however, some users were more sceptical about the development of PIPR methods and how ONS has communicated this so far. Some of these users had particular concerns about the use of PIPR private rents data for estimating OOH in CPIH.

1.51 Although most users gave positive feedback about ONS’s engagement with them ahead of PIPR’s initial publication, it is not clear what ONS’s ongoing user engagement approach with PIPR users looks like beyond the initial publication of the series or its established consumer price inflation stakeholder and technical panels. In particular, ONS has focused its regular engagement activities on consumer price statistics users. Consequently, it is not clear that it understands the needs of devolved housing market users or has a plan or strategy for engaging with them going forwards.

1.52 It is also important that ONS actively support the appropriate interpretation and use of PIPR estimates by new users, particularly those interested in using its new granular estimates for local-level housing market analysis. Engagement with a range of users will be particularly important in assessing the ‘in development’ status of the UK PIPR series once it is published, in line with the stages included ONS’s Guide to official statistics development.

Requirement 3: ONS should publish information on its planned approach for engaging with a range of PIPR users beyond PIPR’s initial publication, including once the UK index is published, and particularly how it will support users of PIPR for housing market analysis. Publishing this will help users see how their needs will be understood and supported and maximise the value of further PIPR developments. ONS should publish a summary of the user feedback that it receives from its evaluation of PIPR’s ‘in development’ status once the full PIPR UK index is published.

Back to topFeedback and further developments

Users’ initial feedback on PIPR is positive, though ONS should publish its response to users’ requests and further details on PIPR’s development

1.53 Overall, PIPR has been almost universally received by the users that we spoke to as an improvement that better meets their needs than the previous IPHRP series. The PIPR statistics are presented clearly and objectively explained, with supporting charts, graphs and heatmaps. A new housing market tool also allows users to see local area-level estimates and trends in house and rental prices. The PIPR publications are in accessible formats, equally available to all, and published at the lowest level of detail available.

1.54 From our conversations, users seem happy that they have data at lower levels of geography than before and spoke positively about the availability of more-granular data from 2015. Many users asked whether it would be possible for a historical PIPR series to go back further than 2015 for modelling purposes. ONS recently replied that it will not be releasing a PIPR series earlier than 2015 as it does not have confidence in the quality of the data before this date.

1.55 Users have made a variety of requests for further measures, including:

- median and quartile rent estimates to support analysis affordability analysis in relation to LHA rates in different areas, and replicating rent distribution analysis that was previously available in the PRMS bulletin

- London and non-London breakdowns to understand how high rents in London might skew the national averages

- separate PIPR estimates for new and existing rents. These estimates were requested by many users, and the Scottish Government believes that this could be a solution that allows users to make more-accurate comparisons across UK nations

- revisions to previous CPIH figures to reflect the effect of PIPR’s higher rates of rental price inflation over a longer period, including the period between ONS’s December 2023 impact analyses and PIPR’s initial publication in March 2024

- the regular publication of comparisons between PIPR estimates and housing industry series based on advertised rents, such as those published by Homelet, Zoopla and Rightmove

- the publication of confidence intervals to potentially to illustrate the quality of the source data

- the inclusion of four-digit CDID identifiers so that the statistics can be referenced by some users in automated coding, rather than being manually downloaded

- improvements to the access and navigability of PIPR estimates on the ONS website

- making the dataset easier to navigate and manipulate as the statistics are all in one tab. However, the previous IPHRP dataset was split into separate tabs, as is the UK Housing Price Index (HPI).

- improved signposting for publishing PIPR in combination with UK HPI – as much of the previous ONS UK HPI material has been removed, and people now need to go to the HM Land Registry bulletin for this instead

- resolving issues with data downloads from the ONS website on the morning of publication

- access to detailed rents microdata or, if that is not possible, the provision of synthetic data, which could help users visualise the data processes in relation to the methods used

1.56 While users would like to see many of the improvements listed above and meeting all users’ requests may not be possible, ONS has not yet clearly set out what further developments it might make in response to user feedback; which developments it will prioritise; or how it will engage with PIPR users to gauge how its developments have been received on an ongoing basis. Although the development and publication of PIPR is a key milestone, users would also like to know what additional developments ONS is planning.

1.57 ONS published a development plan to support PIPR’s initial implementation. However, it has not updated or released a new plan which sets out its known planned developments; which further developments in relation to additional user requests it will or will not take forward; or its plans to move PIPR from ‘in development’ status to ‘official statistics.’ ONS also commissioned reviews by ONS methods experts which highlighted additional developments with the potential to improve methods and data quality that ONS should explore.

Requirement 4: To support user understanding of ONS’s development approach, ONS should clearly communicate any further planned improvements that it intends to make in response to user feedback, and which user requests it will and will not take forward. ONS should also publish its plans for evaluating PIPR’s ‘in development’ status once it has published NI and UK estimates; and for taking forward findings from its own reviews of PIPR data quality and methods. Doing so will support users’ confidence in ONS’s approach to developing UK PIPR estimates; ensure that users are aware of planned and potential future improvements; and maximise the quality and value of future developments.

1.58 ONS’s stakeholder and technical panels on consumer prices provide good opportunities for external challenge to ONS’s approach to measuring consumer prices, including as it developed PIPR. However, some users told us there had been delays in getting some historical panel minutes and papers published. These delays had resulted in these users not being able to access records of previous panel meetings relating to PIPR’s development in a timely manner.

1.59 During the assessment, we found that many past panel papers and minutes relating to PIPR’s development were not published due to their market sensitivity at the time. Given that PIPR is now in production and the market sensitivity of these materials has reduced, ONS could consider which of these papers might now be appropriate to publish, with the consent of the data owners, to support a wide and transparent understanding of PIPR’s development.

Requirement 5: To support transparency and user confidence in the governance and oversight of consumer prices, ONS should review which of its historical panel minutes and papers that relate to PIPR’s development, and were restricted due to market sensitivity may now be suitable for publication, subject to the consent of the data owners.

Back to topEnsuring an orderly publication approach

1.60 PIPR publications are released at 9:30am on the second or third Wednesday of every month, the same day the consumer inflation series is released. Although the consumer inflation series is normally released at 7am, ONS told us that PIPR is released at 9:30am as ONS considers PIPR unlikely to be a market-moving series.

1.61 During the assessment, we identified that ONS had only pre-announced PIPR releases for the forthcoming 8 months rather than the 12 months required by the Code of Practice. ONS told us that there had been a delay in setting the PIPR dates and it would review its processes to ensure that there was always a release schedule for PIPR spanning at least 12 months ahead. This omission has since been rectified, with PIPR publications currently scheduled through to January 2026.

1.62 Some users told us that they had experienced issues opening the latest dataset around the time of release on the day of publication. Some said there was a delay in accessing the latest datasets, with one user commenting that the previous months data had been uploaded, and another stating that the dataset was available only as a read-only version. ONS told us that there were some known issues due to high levels of traffic on the ONS website that particularly affected the data published alongside its headline 7am publications. This issue meant that it could sometimes take a few minutes following a publications’ scheduled release time for a users’ device cache to refresh and show them that the latest data had been published. Planned changes to the ONS website may have the potential to reduce such issues in the future.

Back to top