Data quality

1.29 Estimates of taxation revenue are built up using data from 37 different data sources. A large proportion of these data sources is supplied by HMRC, other areas of ONS and the Department for Business, Energy and Industrial Strategy.

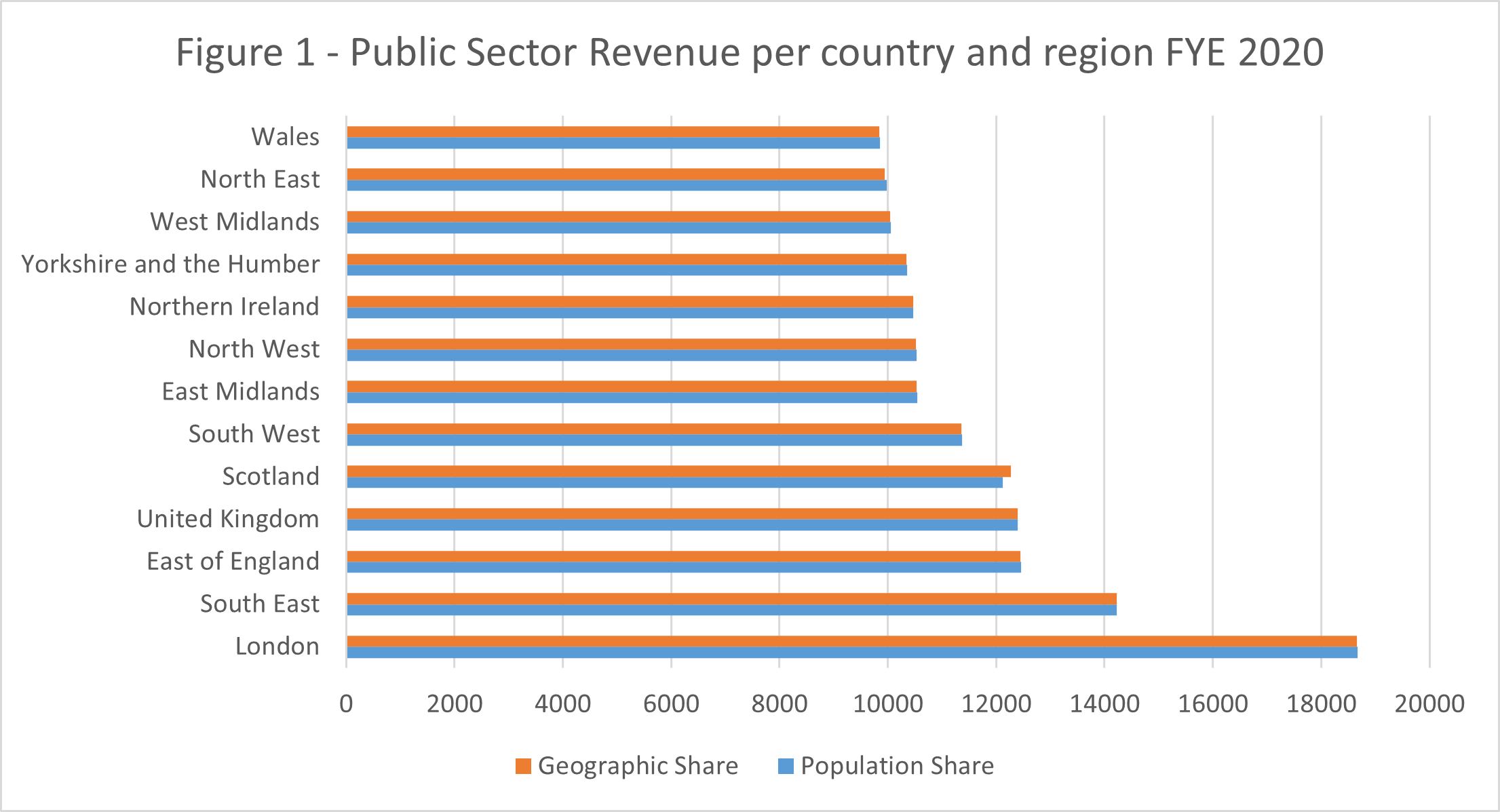

1.30 As taxation revenue is not collected on a regional basis, ONS apportions UK revenue totals to the nations and regions. Apportionment is based on several different techniques, including survey-based information, population estimates and model-based assumptions. Each of these approaches to apportioning taxation data introduces some uncertainty into final estimates. It is especially important that ONS describes this uncertainty to enable appropriate use of the statistics given that many estimates are similar to each other, as shown in Figure 1.

Figure 1 – Public Sector Revenue per country and region FYE 2020. Source: ONS 2020 CRPSF Published statistics

1.31 Examples of the different approaches to apportioning data that introduce uncertainty are:

- Estimates of Value-Added Tax (VAT) revenue are apportioned to countries and regions using estimates of households’ average weekly expenditure from ONS’s Living Costs and Food Survey (LCF), which is subject to survey error, as noted in OSR’s review of LCF.

- Estimates of Corporation Tax are apportioned to countries and regions using the ONS’s Inter-Departmental Departmental Register (IDBR). The IDBR contains information from a variety of administrative and survey sources – including the Business Register Employment Survey (BRES) – which cover a range of time periods and definitions. (Concerns over the quality of data held on the IDBR were highlighted in Bean’s 2016 review of economic statistics and latterly in OSR’s 2019 assessment of Business Demography statistics).

- Mid-year population estimates are used to apportion Offshore Corporation tax receipts to countries. Statistical uncertainty of population projections increases the further we move away from years when the Census is held. In addition, in OSR’s 2021 review of population estimates and projections, OSR noted that:

“at the subnational level, it is widely understood by users that the accuracy of the population estimates will be variable due to factors such as the size and mobility of the population in a given area”.

Requirement 2. ONS must explain to users the statistical uncertainties around CRPSF statistics arising from the choices of data sources and methods, being especially clear on how these uncertainties affect interpretation of statistical estimates that are similar.